Fusion Markets offers a wealth of educational resources for beginners, including beginner guides and news feeds. The company also offers sentiment analysis and demo accounts. The customer support at Fusion Markets is responsive, and you can reach them via email or by phone. The company also offers a comprehensive FAQ section. It also offers a number of payment options, including debit and credit cards. The broker is based in Australia, but offers trading services worldwide. Its services are available through MT4 and metatrader5, and it offers a free demo account. It offers over ninety currency pairs and 24 hour access to market data. The website also provides a number of advanced features, including copy trading and autotrade functionality. However, the product offering is somewhat limited.

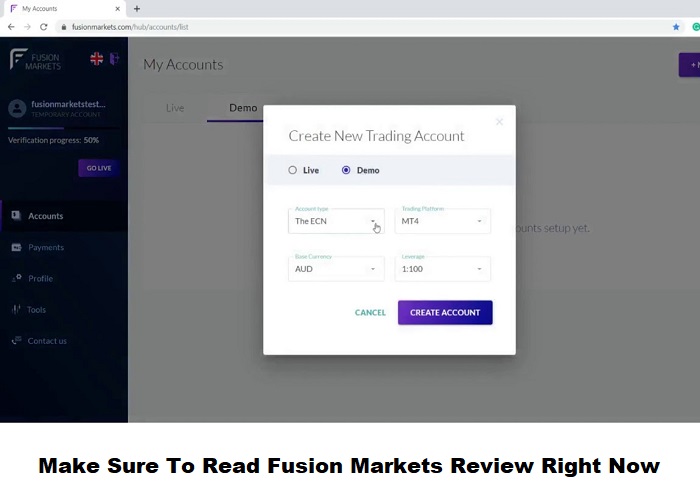

While there are few negative reviews online, there are some cons. One of them is that the broker is not regulated in Canada according to fusion markets review. Another drawback is the lack of educational tools and investor protection. While the company does offer demo accounts, they are not regulated in Canada. To sign up for a live account, you must complete an online application, verify your personal information, and load your account with funds. To get started, it’s recommended to use a demo account first before making a real money investment.

While fees and commissions vary between accounts, they are competitive in the industry. For new traders, the Classic Account is a great choice. This account doesn’t require commissions to be calculated, which means it’s ideal for the novice trader. Furthermore, the Zero Account doesn’t require any minimum or closing balance, which is great for those who are new to the market. Fusion Markets charges a low AUD 4.50 per round-turn trade. Funded trader programs can be highly profitable, but you must be careful when deciding on which one to join. While many of these programs are well-founded and provide a good service, there are also scams out there that take advantage of unwary customers. The funds that are provided by a funded trader program are taken from their profits. Some companies keep as much as 50% of your profits, while others keep as little as 30 percent.

A PayPal broker can be a great choice for traders because of the numerous benefits it provides, including low trading costs, low spread charges, and multiple technical tools. The broker may also offer a demo account that doesn’t expire, which can be a great option for traders who are just starting out or don’t have a lot of money to risk. Most PayPal Brokers charge a fee for their services, and this fee is usually based on the amount of money you have in your account. If you have a large balance, the fees will be higher. Most reputable brokerages offer a free trial account, which can help you evaluate the pros and cons of the brokerage.

If you’re thinking of using paypal brokers, it’s worth your time to do your research. You can easily compare the features of various brokers, as well as their bonus programs. Make sure the broker you choose is one that can meet all of your trading needs. In this way, you can make an informed decision and minimize risk. PayPal is a global payment platform that supports over 200 countries. It also supports over 25 different currencies. If you’re trading in another country, you’ll want to find a broker that supports your currency. The problem with offline currency exchange is that it’s time-consuming and expensive. With PayPal, you can convert currencies without hassle and can link your debit or credit card to your account with the broker.